In Business? Get A Buy-Sell Agreement!

If you own all or part of a business—any business—you should know about buy-sell agreements. Unless you plan to be lucky forever, you’d better have one. Without it, a closely held or family business faces a world of financial and tax problems on an owner’s death, incapacitation, divorce, bankruptcy, sale or retirement.

The cost of a buy-sell is tiny compared to its benefits. A buy-sell agreement can ward off infighting by family members, co-owners and spouses, keep the business afloat so its goodwill and customer base remain intact, and avoid liquidity problems that often arise on these major events.

A buy-sell agreement makes sense for any business entity, including corporations, partnerships, Pvt Ltds (Sdn Bhd) and even proprietorships. How much you need a buy-sell depends on how many owners there are and who else might be waiting in the wings with a financial stake in the business.

Example: You and your partner John run a burger stand as 50/50 partners. You might have a written agreement or a mere handshake. John dies. Do you still have a business? Is John’s wife or child your new partner? Do you have the right or the obligation to buy them out? If so, for how much and on what terms? Can you strike out on your own with your own burger stand, or are you stuck with the baggage of the old one? What if you die instead of John?

As this example shows, the most basic business can benefit from a buy-sell, even if it’s the only written document the business has. Disputes and confusion can result without one even in a small business, and the stakes go up with larger and more complex businesses. You can have a buy-sell agreement with two owners or with many. Suppose you have 10 owners in a family company and someone tries to transfer their shares to a competitor? Such events are easy to prevent with a buy-sell but very expensive otherwise.

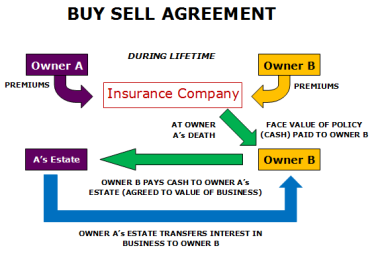

Insurance features prominently in many buy-sell agreements. You don’t have to use insurance, but it can ensure there’s cash available when the time comes. For example, whether you or John dies first, a life insurance policy on each of you can fund the buyout so your burger stand stays afloat and so spouse/heirs are bought out as agreed.

Ideally, buy-sell agreements are fully funded, and life insurance is frequently used for this purpose. After determining the value of the business, you, your advisors, and the other parties to the agreement will determine the best way to fund the transaction, and the triggers appropriate for your business situation.

If you think that a buy-sell agreement might benefit you and your business, click here for a FREE consultation!